In 2025, South Africa’s solar market is more dynamic than ever. Eskom tariffs climbed 12.74% for direct customers and 11.32% for municipal customers (Africa.com, Jan 2025), while municipal feed-in programmes are expanding — but rates vary widely:

- Cape Town: R1.0123/kWh + R0.25/kWh incentive (ex-VAT) for Small-Scale Embedded Generation (SSEG) exports (City of Cape Town Budget 2025/26).

- Johannesburg: ~R0.43/kWh feed-in.

- Nelson Mandela Bay: net-metering at full retail tariff.

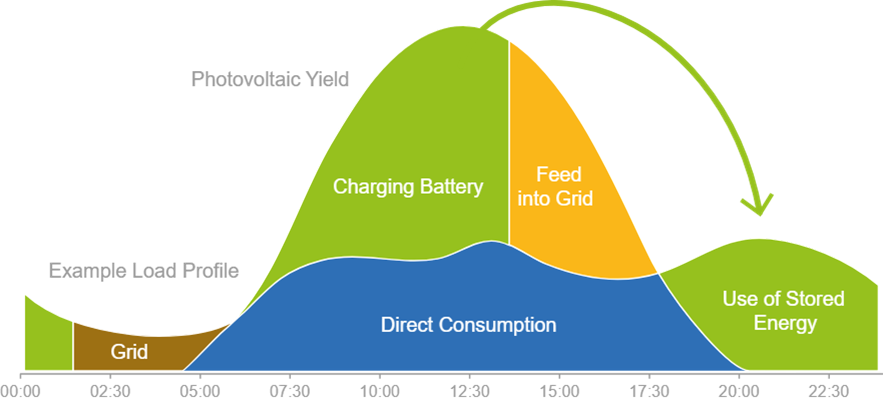

This creates a critical design question for installers: Should you optimise PV + battery systems for maximum self-consumption, or for feed-in revenue? The answer isn’t one-size-fits-all — and your ability to model the difference will make or break your proposals.

Why Self-Consumption Matters

With most municipalities paying less than the retail rate for exported power, the economic case for keeping generated electricity in-house is strong.

A battery increases the proportion of PV generation used onsite — often from 30–40% to 60–80% — which directly offsets grid imports at retail prices (typically R2.50–R3.50/kWh for residential TOU tariffs).

When Feed-In Shines

In metros like Nelson Mandela Bay, where feed-in is at full retail value, exporting surplus can be lucrative — especially for businesses closed on weekends or with low daytime consumption. In Cape Town, the 25 c/kWh incentive sweetens the deal, but only if your system size and load profile still ensure good self-use.

Example: Two Approaches in Cape Town

- Self-Consumption Focus:

- 8 kWp PV + 10 kWh battery

- Self-use rises to 78%, grid imports drop sharply

- Annual saving: ±R41,000 from import reduction; ±R3,000 from exports

- Feed-In Focus:

- 12 kWp PV + 5 kWh battery

- Self-use only 52%, large midday surplus exported

- Annual saving: ±R28,000 from import reduction; ±R13,000 from exports

Result: ROI is similar in year one, but self-consumption systems are less exposed to future feed-in tariff cuts.

Solutions, Business Case, Challenges & Opportunities

Business Case:

- Self-consumption prioritises certainty — savings are based on avoiding purchases at known retail prices.

- Feed-in works best where tariffs approach retail value or where business loads are low during the day.

Challenges:

- Tariff structures differ by municipality and can change annually.

- TOU (time-of-use) pricing complicates value calculations — exported kWh at midday may be worth less than imported kWh at peak.

Opportunities:

- Use design software to create scenario comparisons for clients.

- Position batteries as both a self-consumption booster and a load-shedding solution — adding non-financial value.

Practical Tips for Installers ✅

- Start with Load Profiling — Use client meter data to map hourly consumption and identify the best PV-battery sizing strategy.

- Model Municipal Tariffs — Always simulate with the actual feed-in and retail tariffs for the client’s city, including TOU rates.

- Design for Flexibility — Choose hybrid inverters and modular batteries that can adapt to future tariff changes or larger loads (e.g., EV charger).

- Discuss Non-Financial Benefits — Reliability and load-shedding protection often seal the deal, even when ROI is close between strategies.

- Review Annually — Offer clients a system check-up!

The Unique Value of Makt 🚀

With Makt, installers can:

- Simulate self-consumption vs feed-in scenarios using municipality-specific tariffs and incentives.

- Combine PV, battery, and other tech (EV chargers, heat pumps) in one proposal.

- Deliver 4-in-1 feasibility analysis — technical, financial, regulatory, operational — instantly.

- Use the advanced 3D design tool to present layouts with shading and yield data.

- Share white-label reports via a branded client portal.

- Manage the entire sales workflow — from lead generation to bill of materials management — in one place.

- Outperform PV-only tools that can’t model multi-tech systems or feed-in tariff complexity.